New app reveals the real costs of buying a car

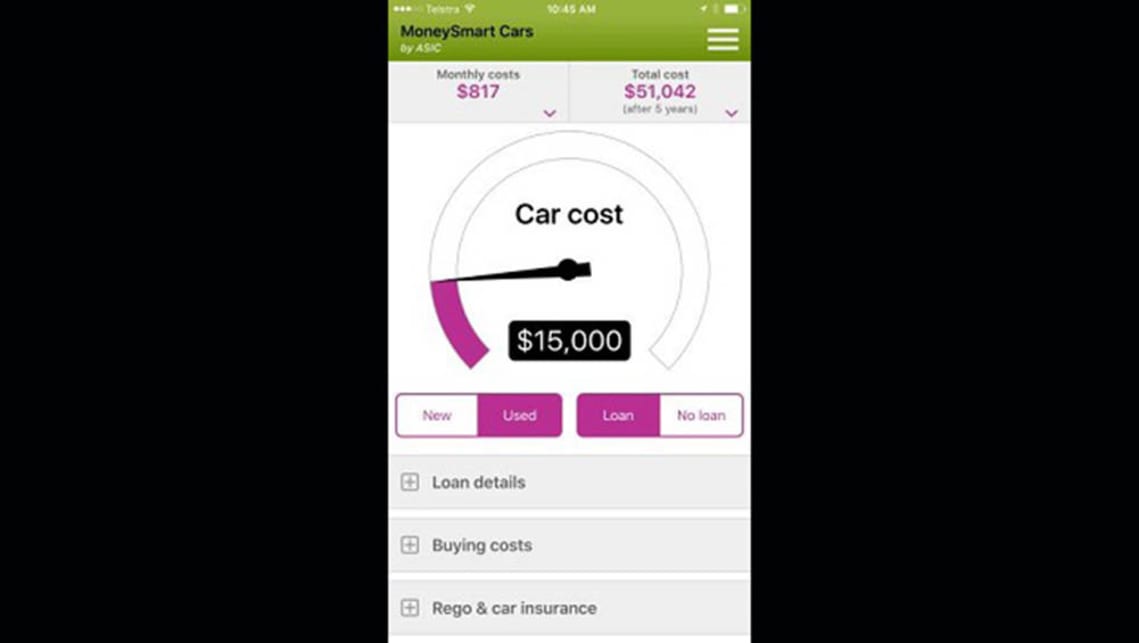

If you buy a $15,000 used car on finance it could end up costing you $50,000 over five years.

That sobering news was delivered this week by the Australian Securities and Investments Commission.

ASIC has launched a new app called MoneySmartCars designed to help people estimate the real cost of running a car — and avoid what it claims can be thousands of dollars in hidden costs.

The app, which is unlikely to be well received by car dealers, looks at "car insurance traps" and contains warnings about extra insurance and car modifications you don't need.

ASIC deputy chairman Peter Kell says the average car debt per household is $19,500 and many people don't take into account the cost of registration, insurance, servicing and running costs when working out whether they can afford a new car.

Consumers can pay up to 18 times more for life insurance purchased through a car dealer.

"Many consumers fall prey to poor financial decisions, when in a car yard for example, because they may be solely focused on the car or overwhelmed by information overload," Kell says.

He highlights a recent ASIC report that found consumers can pay up to 18 times more for life insurance purchased through a car dealer.

The app has a case study on a buyer called Susie, who reportedly borrowed $20,000 to buy a car and spent $8000 on extra insurance products. It claims that with interest, she ended up spending $10,000, half the price of the car.

Consumer and credit insurance and gap insurance ended up costing her $3000 over the life of the contract, while an extended warranty cost her $5000.

It also warns against signing up for balloon payments and secured loans, which are cheaper but allow the dealer to repossess the car to pay off a debt.

Comments